THE TIME FOR

CLIMATE ACTION

IS NOW

CIRCLE OF RESILIENCE OPPORTUNITY ACTION IMPACT LIFE

CLIMATE AND COMMUNITIES

AAVISHKAAR GROUP IMPACT REPORT 2023

136 Mn+

$4.2 Bn

$1.3 Bn

Assets Under Management

14/17

SDGs that Aavishkaar Group is contributing to

Key Sections of the Report

Vikas Bali

Chief Executive Officer, Intellecap

Vasudhaiva Kutumbakam

One Family, One Earth, One Future

The Aavishkaar Group has been steadfast in its commitment to address the problems of the underserved communities, who will be affected the most by climate change, including women. Hence, our Group’s constituent arms are at the forefront of helping address the climate agenda.

Vineet Rai

Founder and Chairman,

Aavishkaar Group

Circle of Life

Community, Development, Climate

To me it appeared that while we succeeded in igniting the imagination of the capitalist world around impact investing, the real challenge lay with climate change. As I shared my learnings, I realized I was not the only one brooding about this, and this sentiment was shared widely. One of the key outcomes of this realization was the integration of climate change in Aavishkaar Group’s impact thinking to encourage its impact investment in climate-linked recourses.

Our Impact in Numbers

$1.3 Bn

Assets under management

$460 Mn

MSME Finance Disbursed

$3.5 Bn

Microfinance Disbursed

$277 Mn

Equity Capital Disbursed

$4.2 Bn

Total Capital Disbursed

118

Countries

8,600+

Total employees

15%

Women Employees

27%

Women in Senior Management

2,548

Enterprises showcased through Sankalp (Global + Africa) Connected to over

1,089

investors

31

Sankalp Conferences (Global + Africa) world’s largest Convening on Impact Entrepreneurship

60

Enterprises disbursed Equity Capital directly

78%

Companies with operations in Low Income States in India and Frontier Countries

32%

Women-led Enterprises

3.37x

Per $1 invested, Enterprises raised

12,600+

MSME clients served directly

34%

Women-led MSME clients

7,400+

Women-led MSMEs and self help groups supported with capital & capacity building initiatives by the Group

$5.6 Mn

Enterprises facilitated with Capital worth

$1.1 Bn

via investors

3,039

Early-stage companies incubated and supported by the Group

116K+

Jobs Created

53K+

via Investments (10% Women)

63K+

via MSME Clients

Disbursed

Presence

Building Initiatives

Impact Output

$1.3 Bn

Assets under management

$460 Mn

MSME Finance Disbursed

$3.5 Bn

Microfinance Disbursed

$277 Mn

Equity Capital Disbursed

$4.2 Bn

Total Capital Disbursed

118

Countries

8,600+

Total employees

15%

Women Employees

27%

Women in Senior Management

2,548

Enterprises showcased through Sankalp (Global + Africa) Connected to over

1,089

investors

31

Sankalp Conferences (Global + Africa) world’s largest Convening on Impact Entrepreneurship

60

Enterprises disbursed Equity Capital directly

78%

Companies with operations in Low Income States in India and Frontier Countries

32%

Women-led Enterprises

3.37x

Per $1 invested, Enterprises raised

12,600+

MSME clients served directly

34%

Women-led MSME clients

7,400+

Women-led MSMEs and self help groups supported with capital & capacity building initiatives by the Group

$5.6 Mn

Enterprises facilitated with Capital worth

$1.1 Bn

via investors

3,039

Early-stage companies incubated and supported by the Group

116K+

Jobs Created

53K+

via Investments (10% Women)

63K+

via MSME Clients

Our Storytellers

Halima Begam

WEATHERING THE STORM

INSTILLING HOPE, REBUILDING A HOME

Arohan (An Aavishkaar Group Company)

Pratik Dalmia

Executive Director, Dalmia Polypro Industries

Aditya Dalmia

Managing Director, Dalmia Polypro Industries

Altering Perceptions

Paradigm Shift to a Circular Future

Dalmia Polypro Industries

Atreya Rayaprolu

Chief Technology Officer, Ashv Finance

Building a Green Ledger

for Sustainable Businesses

Ashv Finance (An Aavishkaar Group Company)

Bharat Bhushan

Co-founder, Bharat Solar Systems

Neetu Choudhary

Co-founder, Bharat Solar Systems

Harnessing the Sun

To Illuminate Communities

Bharat Solar Systems

Sanchayan Chakraborty

Partner, Aavishkaar Capital

Sowmya Suryanarayanan

Director, Impact and ESG, Aavishkaar Capital

COMMUNITY AT THE FOREFRONT

MEASURING BEYOND EMISSIONS

Aavishkaar Capital (An Aavishkaar Group Company)

Rochan Sinha

Co-founder & CTO, Newtrace

Prasanta Sarkar

Co-founder & CEO, Newtrace

Electrolyzing the Future

Disrupting the Green Hydrogen Industry

Newtrace

Abhishek Mittal

Partner, Aavishkaar Capital

Ashish Patel

Managing Partner, Aavishkaar Capital

Monu Jain

Partner, Aavishkaar Capital

Reimagining Credit

Promoting Sustainable Consumption

Aavishkaar Capital (An Aavishkaar Group Company)

Divya Gupta

Director, Aavishkaar Capital

Anurag Agrawal

Partner, Aavishkaar Capital

Unearthing Value From Waste

Nurturing Innovation

Nepra Resource Management and Aavishkaar Capital (An Aavishkaar Group Company)

Majeda Khatun

Sewing Operator, Al-Muslim Group

Threads of Empowerment

Weaving Livelihoods for the Future

Circular Apparel Innovation Factory (CAIF), Intellecap (An Aavishkaar Group Company)

Santosh Singh

Managing Director, Intellecap

Charting Climate Action

For a Shared Future

Intellecap (An Aavishkaar Group Company)

Gurjit Singh

Former Ambassdor of India to Germany

Catalyzing Youth Entrepreneurship

Fostering Social Equity

Aavishkaar Foundation (An Aavishkaar Group Company)

Aavishkaar Group is actively contributing to 14/17 SDGs

10.5 Mn People supported with Affordable Financial Services via Investments (96.7% Women)

5.6 Mn Microfinance clients served directly (98% Women)

77 Mn People provided with access to financial services (50% Women)

13Mn Farmers supported with livelihoods, products, and services via engagements and investments

2.3Mn People provided with affordable healthcare via investments (56% Women)

3.4Mn+ Students provided with affordable, quality education via investments (50% Women)

7427 Women Led MSMEs supported directly with Finance and Capacity Building Services

15.5Mn People provided with sanitation facilities via Group companies and investments; (50% Women)

6.92Mn People provided with potable drinking water via investments (50% Women)

1.1Mn People provided with solar cookstoves and solar lights via Group companies and investments (90% Women)

655K Jobs and livelihoods created at Group companies and via investments

3039 Early-stage enterprises incubated and supported

56K MSME Provided with Financial Services, Products and Services

2.6 Mn MT CO2 Emissions Reduced

4.2Bn Disbursed in Microfinance, MSME Finance, and Equity Investments to enterprises and individuals in developing countries

7185 People Provided with Financial Services to Build Houses

198K MT Waste recycled via engagements and investments

267 Artisanal fishermen provided with fair-trade market access

267 Artisanal fishermen provided with fair-trade market access

Protect, restore and promote sustainable use of terrestrial ecosystems, sustainably manage forests, combat desertification, and halt and reverse land degradation and halt biodiversity loss.

Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels.

31 "Sankalp Conferences (Global + Africa) - world’s largest Convening on Impact Entrepreneurship"

Building Our Impact Ecosystem

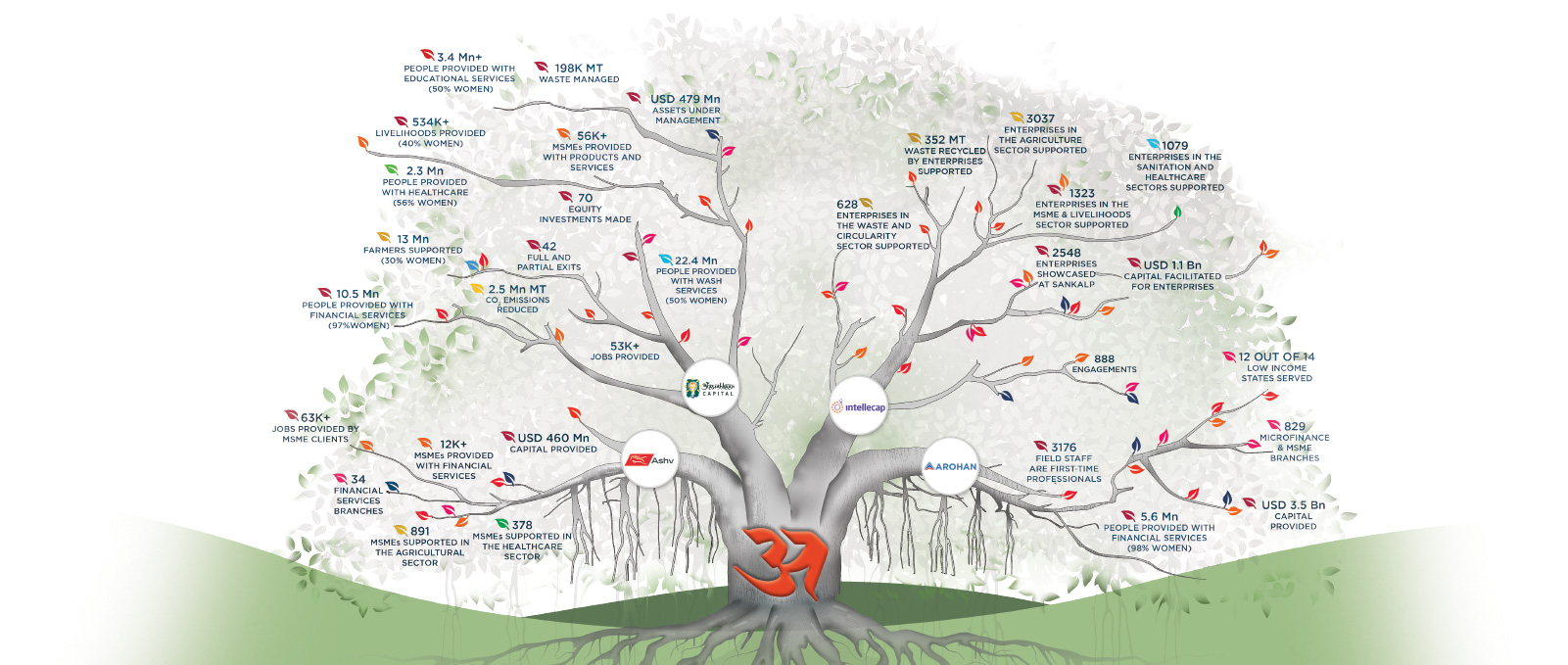

The Aavishkaar Tree

The Aavishkaar Group is diverse and the tree forms a perfect metaphor of our attributes like growth, resilience, grounded, inclusion and sustainability. The Group companies – Aavishkaar Capital, Arohan, Ashv and Intellecap, have their own distinct characteristics but are rooted in these common attributes.

While they individually address a significant part of the journey of low-middle income customers, together they form an enabling ecosystem for the emerging 3 billion. Impact is in the DNA of our Group Companies. Each leaf represents the impact we have been able to create through our journey and takes the colour of the United Nations Sustainable Development Goals (SDGs).